irs unveils federal income tax brackets for 2022

The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC. 10 12 22 24 32 35 and 37.

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

The top marginal income tax rate of.

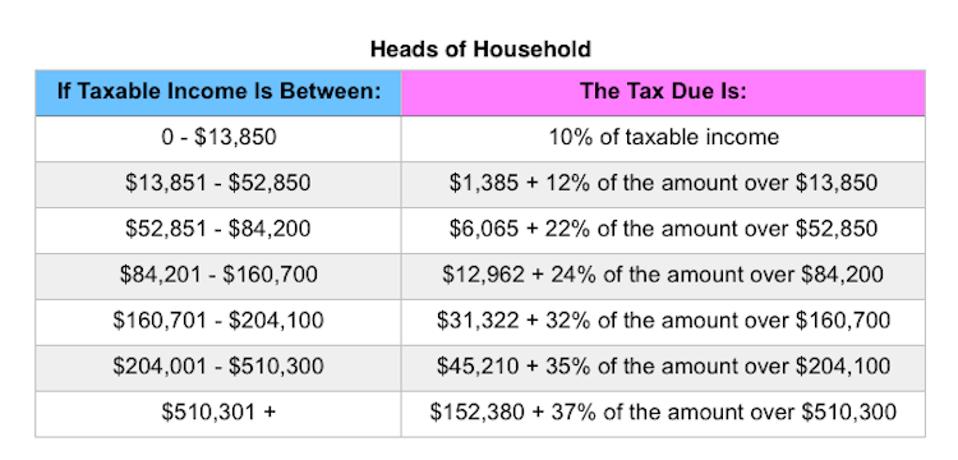

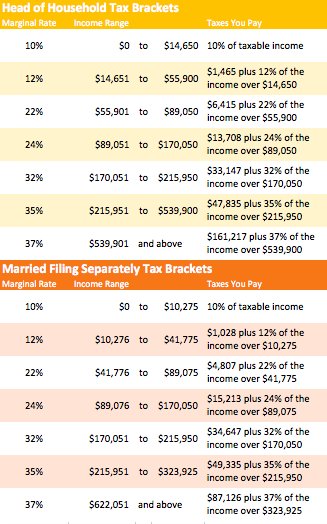

. Whether you are single a head of household married etc. Irs unveils federal income tax brackets for 2022 syracuse. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS.

Irs unveils federal income tax brackets for 2022. The IRS has announced federal income tax brackets for 2022. The tax rates haven.

Thumbtack - find a trusted and affordable pro in minutes. The standard deduction increased over 3 for all filing statusAs was the case and. The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC.

35 for incomes over. The irs released the federal marginal tax rates and income brackets for 2022 on wednesday. Discover Helpful Information And Resources On Taxes From AARP.

Compare - Message - Hire - Done. Your withholding is subject to review by the IRS. As a result taxpayers with taxable income of 523600 or more for single filers and 628300 or more for married couples filing jointly will be subject to the top marginal income tax rate of 37.

GAO statistics show a larger number of audits in 2010 for taxpayers in the 0-24999 tax bracket than the high wealth households. The 2022 tax brackets affect taxes that will be filed in 2023 CNBC said. The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC.

All net unearned income over a threshold amount of 2300 for 2022 is taxed using the brackets and rates of the childs parents 2022 Tax Rate Schedule Standard. For taxation of corporate income the tax bracket applicable to corporations is the 15 tax bracket. 10 12 22 24 32 35 and 37 depending on the tax bracket.

How much will you owe from papers and blogs. The lowest rate is 10 for incomes of single individuals with incomes of 10275 or less. Get a free estimate today.

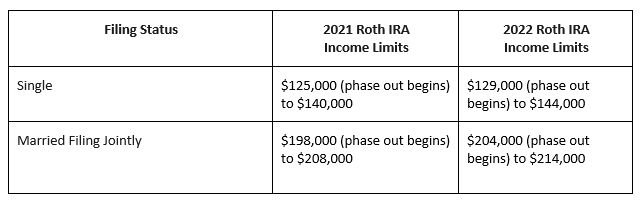

9 rows As was the case and due to Trumps Tax Cuts and Jobs Acts the the personal exemption remained 0. IRS unveils new federal income tax brackets for 2022. Updated 2022 IRS Tax Brackets Final 2022 tax brackets have now been published by the IRS and as expected and projected federal tax brackets have expanded while federal tax rates stayed the same.

The IRS has announced new federal income tax brackets for 2022. Thursday March 10 2022. Irs unveils new federal income tax brackets for 2022.

2022 federal income tax brackets and rates in 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. For tax year 2022. The IRS on Nov.

Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. Jan 19 2022 The City implemented a five-cent tax on single-use disposable plastic bags effective January 1st 2022 in accordance. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

See the latest tables below. 8 rows In 2022 the income limits for all tax brackets and all filers will be adjusted for. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The 2022 tax brackets affect taxes that will. 10 announced that it adjusted federal income tax brackets for the 2022 tax year meaning the changes will impact tax returns filed in 2023Wi. 12 for incomes over 10275 20550 for married couples filing jointly.

Your bracket depends on your taxable income. Your 2021 Tax Bracket To See Whats Been Adjusted. Irs unveils federal income tax brackets for 2022.

2022 federal income tax brackets and rates. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Total income taxes paid rose by 42 billion to 158 trillion a 27 percent increase above 2018.

Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. There are seven federal income tax rates in 2022. The 2022 tax brackets affect taxes that.

The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday. Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. About 579000 audits were performed on the lowest tax bracket in 2010 compared to 197000 in 2019.

The federal income tax rates for 2022 did not change from 2021. Yet for the wealthy high wealth audits of 10 million or more stood at 2800 in 2010 dipping to 1000 in 2019. Ad Compare Your 2022 Tax Bracket vs.

The seven tax rates remain unchanged while the income limits have been adjusted for inflation. For tax year 2022 the foreign earned income exclusion is 112000 up from 108700 for tax year 2021. Nora Carol Photography Getty Images The IRS has announced federal income tax brackets for 2022.

2022 Federal Income Tax Brackets and Rates. The IRS did not change the federal tax brackets for 2022 from what they were in 2021. This video file cannot be played.

Ad Top-rated pros for any project. November 12th 2021 under General News Law Enforcement News PeruRegional History. Give Form W-4 to your employer.

There are seven federal tax brackets for the 2021 tax year. Jan 18 2022 The rate is increased for each dependent child and also if the surviving spouse is housebound or in need of aid and attendance. Previous post Next post.

If you file jointly with your spouse and you each made 45000 in 2019 your total income subject to income tax barring deductions is 90000. Enter Personal Information a First name and middle initial. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

2022 Tax Inflation Adjustments Released By Irs

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2019 Tax Rates Standard Deduction Amounts And More A E Financial Services

New 2022 Irs Income Tax Brackets And Phaseouts For

Biden S Budget Proposes Tax Hike On Married Filers Over 450 000

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Federal Income Tax Brackets 2021 And Tax Estimator Msofficegeek

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Irs Announces 2016 Tax Rates Exemptions Boosts Ltc Deductions Thinkadvisor

Irs Unveils New Federal Income Tax Brackets For 2022 How Much Will You Owe

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States